The Truth About Rebuilt Titles: Pros and Cons

At MPG Auto Sales, we specialize in high-quality rebuilt title vehicles. But we often hear the question: "What does that really mean, and is it safe?"

There is a lot of misinformation out there. Let's separate fact from fiction.

What EXACTLY is a Rebuilt Title?

A vehicle receives a Salvage Title when an insurance company declares it a "total loss." This doesn't always mean the car was destroyed. It often means the cost of repair at a premium dealership exceeded a certain percentage of the car's value.

Once that vehicle is repaired and passes a rigorous state inspection by the DMV, it receives a Rebuilt Title. This certifies that the car is roadworthy, safe, and meets all manufacturer safety standards.

The Major Pros

1. Unbeatable Value

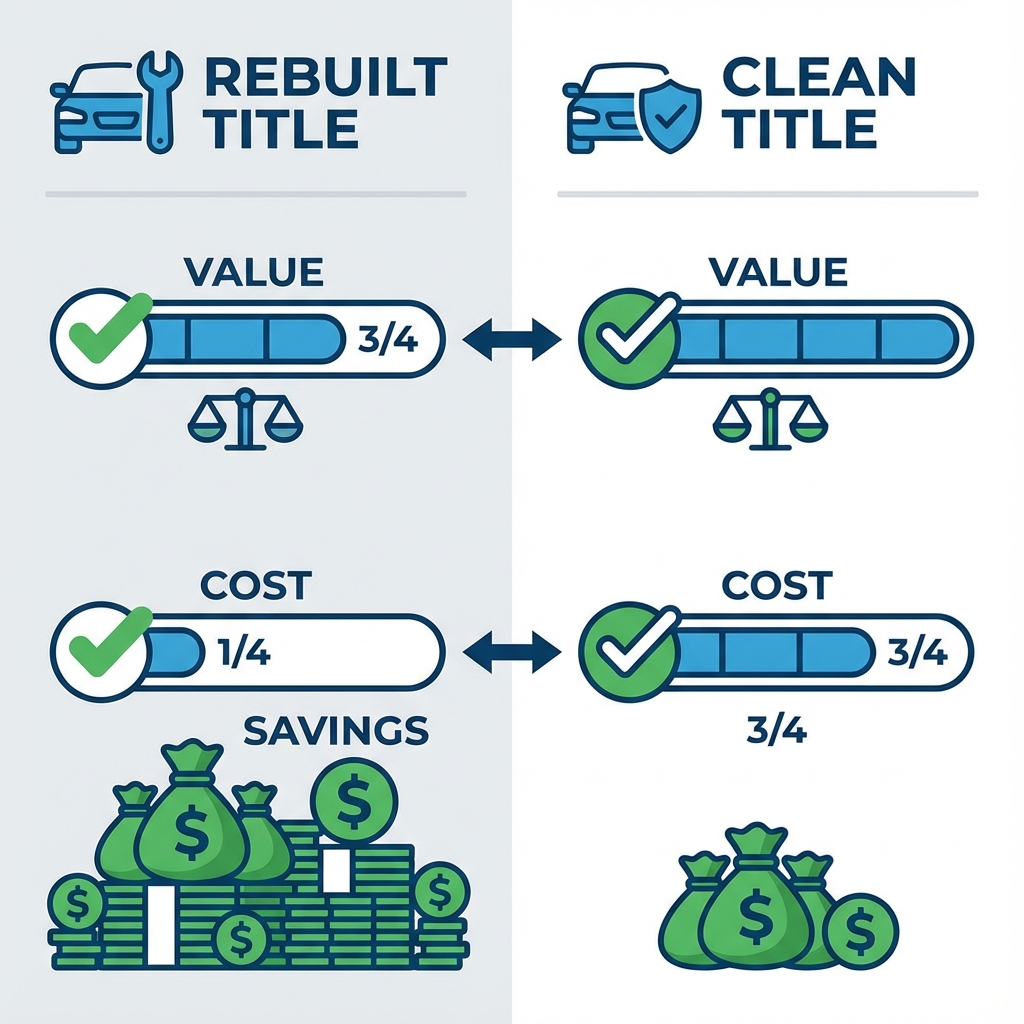

This is the biggest driver. You can often get a newer model with significantly lower mileage for 20-40% less than the same car with a clean title.

- Example: A clean title 2022 Toyota Camry might cost $22,000. A rebuilt title version might be $16,000. That's $6,000 in your pocket.

2. Rigorous Inspections

To upgrade from Salvage to Rebuilt, the vehicle must be inspected by state officials. They check structural integrity, safety systems (airbags, seatbelts), and ensure no stolen parts were used. You aren't just taking a seller's word for it.

3. Slower Depreciation

New cars lose value the moment you drive them off the lot. A rebuilt title car has already taken that initial depreciation hit. When you sell it later, you'll lose less money overall compared to buying new or certified pre-owned.

The Potential Cons (and How We Mitigate Them)

1. Resale Limitations

While you pay less, you will also sell it for less. Major franchise dealerships (like CarMax) often won't take rebuilt titles as trade-ins. However, private buyers and specialized dealers (like us!) often happily buy them back.

2. Financing Hurdles

Some big banks won't finance rebuilt titles. However, MPG Auto Sales works with specialized lenders who understand the value of these cars and offer competitive financing options.

3. Insurance Myths

Myth: You can't insure a rebuilt title car. Fact: You absolutely can. Almost all major insurers (Geico, Progressive, State Farm) write liability policies. Many will even offer full coverage (comprehensive and collision) once they inspect the vehicle or see photos.

The Verdict

For the smart shopper who prioritizes specific features, low mileage, and reliability over a piece of paper, a rebuilt title is the ultimate financial hack in the automotive world.